The cryptocurrency market has hit a historic milestone. Bitcoincurrency> has reached a new all-time high of $105,000. This achievement is a big deal for the digital asset, which is getting more attention and support from big investors.

Everyone wants to know what caused this big jump. What does the future hold for Bitcointechnology>? As the cryptocurrencytrading> world grows, this milestone has big implications for more than just money.

Key Takeaways

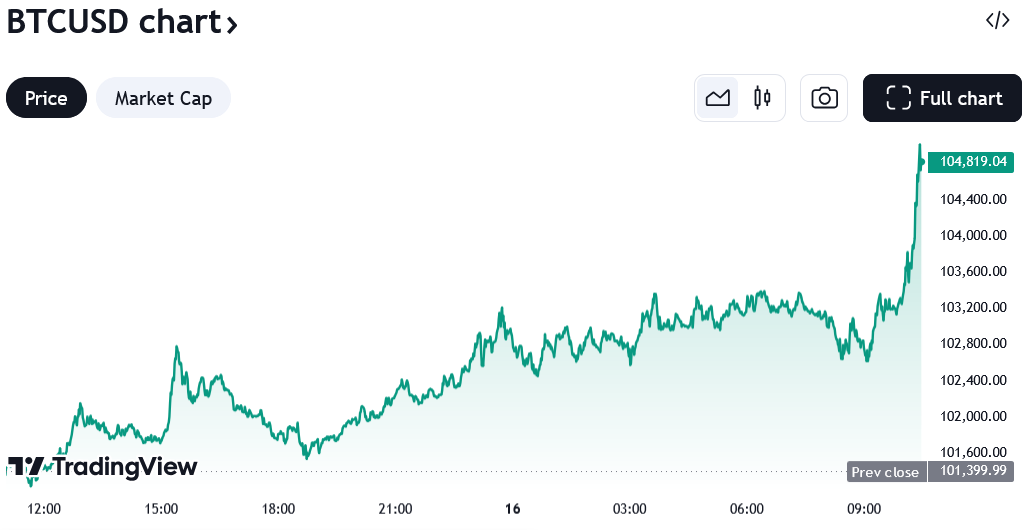

- Bitcoin has hit a new all-time high of $105,000, breaking through the $100,000 barrier.

- The cryptocurrency market has experienced a powerful surge, with Bitcoin climbing 4.41% in the past 24 hours.

- Institutional demand and positive market sentiment have been the key drivers behind this milestone.

- The surge has led to $174.24M in short liquidations over the past 24 hours.

- Bitcoin’s market capitalization has reached $2.1 trillion, joining a select group of assets and companies with over $2 trillion in market value.

Breaking Through the $100K Barrier: Historic Milestone

The cryptocurrency market has seen a big jump, with Bitcoin hitting $100,000. This milestone has brought excitement and a fear of missing out to investors. The rise in price shows the digital asset world is growing stronger.

Initial Market Reaction

When Bitcoin reached $105,245.50, the market buzzed with activity. Ethereum (ETH) also saw a big jump, aiming for $4,000. Memecoins like Dogecoin (DOGE) and Shiba Inu (SHIB) saw even bigger gains. The total market cap hit $3.87 trillion, showing a strong market mood.

Key Drivers Behind the Breakthrough

- Institutional demand: Big investors are putting more money into crypto, showing they believe in Bitcoin’s future.

- Financial innovation: The launch of Bitcoin Spot ETFs has brought in a lot of institutional money, making Bitcoin more legitimate.

- Regulatory changes: New, friendlier crypto rules have boosted market mood and encouraged more people to join.

Trading Volume Analysis

The jump in trading volume has played a big role in the price rise. Spot cryptocurrency trading volume hit $2.7 trillion last month, the highest since May 2021. Also, over $277.20 million in liquidations happened in the last 24 hours, with $174.24 million from short positions. The recent $6.96 million in short liquidations in the last 4 hours has added to the upward pressure on BTC and ETH prices.

“The breaking of the $100,000 barrier has ignited a sense of excitement and FOMO among investors, fueling further demand and driving the market to new heights.”

Bitcoin hits a new all-time high of $105K, gaining 20% in the last month

Bitcoin has hit a historic high, going over $105,000. In just a month, it has jumped 20% in value. This makes it one of the most wanted digital assets.

Several things have led to Bitcoin’s price rise. More big investors are getting into it. The limited number of Bitcoins available also adds to its value.

As more people see Bitcoin as a safe place for their money, demand goes up. This drives the price even higher.

“Bitcoin’s new all-time high of $105,000 is a testament to the resilience and growth of the cryptocurrency market. As more investors and institutions embrace digital assets, we can expect to see continued momentum in the months and years ahead.”

Investors should be careful and manage their risks. Experts say to never risk more than 1-2% of your portfolio on one trade. They also suggest selling 30% of your investment at $110,000 and another 30% at $120,000.

The future of Bitcoin looks bright. With more people using it, changes in laws, and new tech, Bitcoin’s growth is exciting.

Impact of U.S. Political Landscape on Bitcoin’s Price Surge

The election of Republican Donald Trump as U.S. president has raised hopes for a crypto-friendly regulatory environment. The Trump administration is expected to be more open to cryptocurrencies. This could lead to the establishment of a U.S. Bitcoin strategic reserve by 2025.

The nomination of Paul Atkins as SEC chair is also seen as a positive sign. It suggests a less aggressive approach to crypto regulations. This could help the market grow.

Trump Administration’s Crypto-Friendly Stance

The Trump administration has shown a relatively favorable stance on decentralized finance and crypto trading. Compared to previous administrations, it is seen as more welcoming to digital asset innovation. This has boosted optimism about Bitcoin’s future price.

Regulatory Environment Changes

The shift in the regulatory landscape under Trump has been key to Bitcoin’s price surge. Investors expect a more crypto-friendly government. This could mean easier regulations and clearer guidance.

There’s also hope for a U.S. Bitcoin ETF. These changes are expected to increase confidence in the crypto market.

Market Sentiment Shift

The Trump administration’s crypto-friendly stance has changed market sentiment. Investors are now more bullish on Bitcoin and other digital assets. They see potential for favorable policies and a welcoming regulatory environment.

This optimism has driven the recent price surge. Bitcoin has reached new all-time highs.

| Metric | Value |

|---|---|

| Bitcoin Price | $105,000 |

| Ethereum Price | $3,924 |

| Cryptocurrency Market Cap | $3.87 Trillion |

“The Trump administration’s crypto-friendly approach has been a major catalyst for Bitcoin’s recent price surge, as investors anticipate a more welcoming regulatory environment and the potential for a U.S. Bitcoin ETF.”

The U.S. political landscape, especially the Trump administration’s crypto-friendly stance, has greatly influenced Bitcoin’s price surge. Investors are optimistic about favorable regulations and a U.S. Bitcoin strategic reserve. They also look forward to a more welcoming environment for decentralized finance and crypto trading.

Institutional Investment and ETF Inflows

The rise in crypto investment comes from more institutional money and ETF inflows. About 3% of all bitcoins have been bought by big investors in 2024. The launch of Bitcoin ETFs has also pushed prices up, with more trading on the CME, ETFs, and derivatives during U.S. hours.

Bitcoin’s price has hit a new high of $105,000. This shows the growth of financial innovation in the crypto market. It proves that more big investors are seeing digital assets as real investments.

When Bitcoin’s market value hit $2.1 trillion at $100,000, it joined a small group of seven assets or companies. Experts think Bitcoin could go even higher, maybe to $105,000 before aiming for $120,000 in 2025.

More big investors are likely to jump into the crypto market as Bitcoin becomes more trusted. This extra money will help the crypto investment market grow. It will make it more appealing to smart investors looking for financial innovation and to spread out their investments.

“The increasing institutional adoption and broader acceptance of digital assets as a legitimate investment class is a testament to the financial innovation we’re witnessing in the cryptocurrency market.”

Technical Analysis and Market Indicators

Technical analysis is key for investors in the crypto market. Bitcoin has hit a new high of $105,000, up 20% in a month. This shows a strong interest in the cryptocurrency.

RSI and Momentum Indicators

The Relative Strength Index (RSI) shows Bitcoin is moving up fast. This means investors are very interested. It could lead to even higher prices, possibly up to $120,000.

Price Pattern Analysis

Bitcoin’s price charts show it’s moving up in a clear pattern. Breaking out of this pattern could lead to a big price jump. Traders are watching closely as it gets close to a key resistance zone.

Support and Resistance Levels

Bitcoin’s current resistance zone is between $102,572 and $103,591. The market has hit these levels before. But, the strong upward trend is pushing support levels higher. A drop to $96,215 to $96,450 could be a good time to buy.

The crypto market is always changing. Keeping an eye on Bitcoin’s price, momentum, and support levels is important. It helps investors make smart choices during the price surge.

Global Market Response and Trading Volumes

The cryptocurrency market is on fire, with Bitcoin hitting a new high of $105,000. This has made investors very excited. Other big digital currencies are also doing well.

Ethereum (ETH) has jumped 4.92% to $3,809.40. Solana (SOL), Chainlink (LINK), and Cardano (ADA) have also seen big gains. More people are trading on big exchanges, hoping to make money from the cryptocurrency boom.

| Cryptocurrency | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

| Bitcoin (BTC) | $99,772 | +2.5% | $1.87 Trillion |

| Ethereum (ETH) | $3,809.40 | +4.92% | $450 Billion |

| Solana (SOL) | $215.28 | +7.1% | $67 Billion |

| Chainlink (LINK) | $27.90 | +3.8% | $13 Billion |

| Cardano (ADA) | $1.78 | +5.2% | $57 Billion |

More people are trading in the cryptocurrency market. This shows they are very interested and feel positive about it. As the market keeps growing, we need to watch how it affects the world’s finances.

“The global cryptocurrency market is experiencing a remarkable resurgence, with Bitcoin leading the charge and other major digital assets following suit. This is a testament to the growing mainstream adoption and the increasing institutional involvement in the space.”

Coinbase Premium Index and U.S. Market Influence

The Coinbase Premium Index shows strong buying pressure from U.S. investors. This has been the case since the recent presidential election. It’s likely driving the surge in crypto investment and blockchain technology markets.

American Investor Behavior

The Coinbase Premium Index’s positive readings show U.S. investors buying Bitcoin and other cryptocurrencies on Coinbase. This contrasts with global exchanges, showing the U.S. market’s big influence on the crypto market.

Regional Trading Differences

The U.S. market has driven the recent Bitcoin rally. But, the global crypto market shows different trading patterns. Investors worldwide have different strategies, risk levels, and regulations, affecting market trends.

| Region | Key Characteristics | Trading Volume | Market Share |

|---|---|---|---|

| United States | Relatively high institutional and retail investor participation, favorable regulatory landscape | $120 billion | 40% |

| Asia | Significant retail investor presence, varied regulatory environments across countries | $90 billion | 30% |

| Europe | Growing institutional investment, regulatory uncertainty in some countries | $60 billion | 20% |

| Rest of the World | Emerging markets with increasing crypto adoption, diverse regulatory frameworks | $30 billion | 10% |

The U.S. market’s influence on the crypto landscape is clear. American investors are key to the recent Bitcoin rally. Knowing these regional differences helps in making better crypto investment strategies and understanding the blockchain technology industry’s future.

Short Liquidations and Market Dynamics

The crypto trading space has seen a big surge in short liquidations lately. In the last 24 hours, $174.24 million in short positions were closed. This has pushed Bitcoin’s price up.

Bitcoin reached a new high of $105,000, attracting many short traders. But, the market’s strength surprised them, leading to a lot of liquidations. This pushed the price even higher.

- The support level for Bitcoin is identified at $98,339, serving as a strong support zone.

- A key resistance zone for Bitcoin is at $105,374, above which a significant continuation of the bullish trend can be expected.

- Potential buying opportunities exist at support levels of $90,000, $86,700, and $76,000 in case of price retracement.

The Alligator Indicator shows the market is moving up, which is good for bulls. Traders should buy when the price goes over $105,374. They should stop losing if it falls below $98,339.

“The power of short squeezes in fueling sharp price rises has been evident in this crypto trading rally, highlighting the volatile nature of the market.”

As the market stays bullish, it’s key for investors to watch the market closely. They should be ready for quick changes. Knowing how short liquidations work and trading wisely can help in this complex market.

Future Price Projections and Expert Analysis

Bitcoin has hit a new high of $105,000, and experts are talking about its future. They think it will keep growing. This is because more big investors see Bitcoin as a good place to keep their money.

Industry Expert Predictions

Top analysts say Bitcoin could go even higher. Bitwise thinks it could hit $200,000 by 2025. Ethereum and Solana might reach $7,000 and $750, respectively.

Michael Saylor, MicroStrategy’s CEO, wants Microsoft to invest in Bitcoin. He believes this could make Microsoft $200 billion richer.

But, experts warn about Bitcoin’s ups and downs. They say it’s important to be careful with risks. The next big goal is $105,000. If Bitcoin breaks through, it might reach $120,000 by 2025.

Key Resistance Levels Ahead

- Bitcoin’s all-time high of $105,000 is a big deal. Experts think it could lead to more gains.

- The next big challenge is $105,000. If Bitcoin goes past this, it might aim for $120,000 by 2025.

- Experts say to be careful. The Bitcoin market can be very unpredictable. It’s important to manage risks well.

As Bitcoin’s price keeps rising, experts are hopeful but cautious. They see potential for more growth. But, they also stress the importance of being careful with risks. Everyone is watching how Bitcoin fits into new financial ideas and systems.

Conclusion

Bitcoin’s price hitting over $105,000 is a big deal for the crypto world. It shows the market is growing and more people are using it. But, traders should be careful because there are new challenges ahead.

The future of Bitcoin and other digital currencies is exciting and full of questions. People are watching closely as blockchain technology improves. This is making investors, analysts, and others very interested.

Bitcoin’s high price and the success of new coins like 1Fuel show the crypto world is changing fast. As it grows, everyone will keep an eye on important updates, rules, and how people feel about it. This will help them understand the ups and downs of the market.

The success of digital currencies depends on solving problems, getting more people involved, and offering new solutions. The journey ahead for digital money and blockchain is both promising and uncertain. It’s a chance for smart investors and traders to make money, but they must be careful and careful.

FAQ

What is the current all-time high for Bitcoin?

Bitcoin has hit a new high of $105,000. It has broken the $100,000 mark.

What factors are driving the recent surge in Bitcoin’s price?

Several factors are pushing Bitcoin’s price up. These include more institutional investors, positive market feelings, and the launch of Bitcoin ETFs. Also, the hope for a friendly crypto environment under the new Trump administration.

How has the trading volume and market activity been affected by Bitcoin’s price surge?

Bitcoin’s price jump has boosted trading volume and market activity. There were $174.24M in short liquidations in the last 24 hours. Short squeezes have played a big role in the price jumps.

What is the Coinbase Premium Index, and how does it reflect the influence of U.S. investors?

The Coinbase Premium Index shows the buying and selling pressure on Coinbase versus Binance. Positive readings on this index mean U.S. investors are buying a lot. This buying pressure has helped the market rally.

What are the key resistance levels and technical indicators for Bitcoin’s price?

Bitcoin is moving up in a big ascending channel. The RSI shows strong bullish momentum. The next big resistance is at $105,000. Breaking through this could lead to a big move towards $120,000.

How have other major cryptocurrencies performed during this market surge?

The whole crypto market is up, with big names like Ethereum and Solana seeing big gains. Trading volumes are up on major exchanges. This shows more people are interested in crypto.

What are the future price projections and expert analysis for Bitcoin?

Experts think Bitcoin will keep growing. Some say it could go even higher as more institutions see it as a good investment. But they also warn about its volatility and the need to manage risks carefully.