Bitcoin plummets to $102K on Binance on Friday after U.S. President Donald Trump announced sweeping 100% tariffs on all Chinese imports, reigniting fears of a global trade war and sending shockwaves through crypto markets.

Bitcoin’s BTC/USDT pair on Binance briefly touched $102,000, marking a three-month low. On Coinbase, the spot price dropped to $107,000, while data from CoinGlass showed $9.4 billion in crypto market liquidations within 24 hours — $7.15 billion of which were leveraged long positions.

Tariffs trigger market chaos

Trump’s move comes in response to what he described as China’s “extraordinarily aggressive position on trade.” The president stated on Truth Social:

“It has just been learned that China has taken an extraordinarily aggressive position on Trade… stating that they were going to, effective November 1, 2025, impose large-scale Export Controls on virtually every product they make.”

The tariffs, which target all Chinese goods, were announced as a countermeasure to China’s plan to restrict exports of rare earth minerals — essential materials for semiconductor production, and by extension, AI, high-performance computing, and crypto mining infrastructure.

Crypto market under pressure

Following the announcement, the global crypto market cap tumbled to $3.64 trillion, an 11.8% decline in 24 hours. Ether (ETH) fell 12% to $3,500, while Solana (SOL) plunged 14%, dropping below $140 in futures trading on Binance.

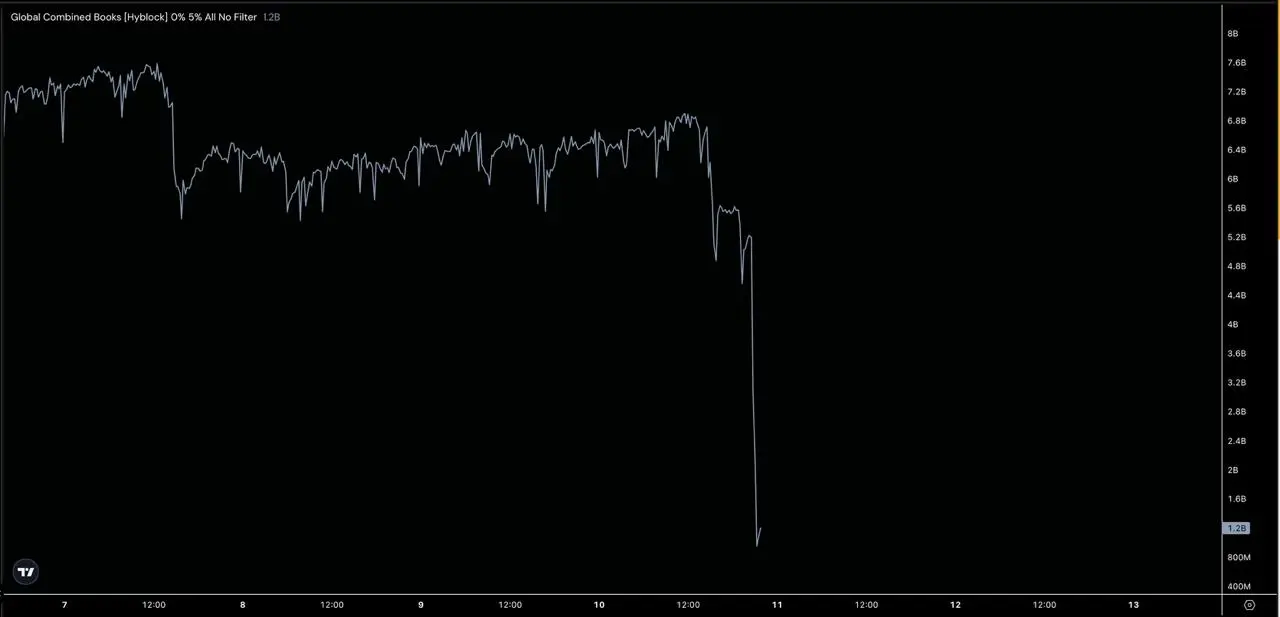

Hyblock Capital analysts noted, “Global 2x leverage on most altcoins was totally wiped out.”

Implications for crypto and global trade

The escalating U.S.-China trade tensions could tighten access to key materials used in crypto mining and chip manufacturing, increasing production costs and reducing hardware supply. Meanwhile, markets are bracing for heightened volatility as investors weigh the impact of prolonged trade restrictions on global liquidity.

The move recalls Trump’s earlier tariff policies, which also rattled risk assets and crypto alike. As geopolitical uncertainty mounts, Bitcoin’s role as a hedge asset is once again being tested.