What is Crypto Market Depth?

In the fast-moving world of cryptocurrency trading, one of the most overlooked yet critical concepts is crypto market depth. For traders, investors, and institutions navigating Bitcoin, Ethereum, and other digital assets, market depth provides a window into liquidity, supply-demand dynamics, and potential price stability.

Understanding market depth goes beyond just reading price charts. It requires analyzing the order book, assessing buy and sell pressure, and interpreting depth charts to evaluate how much impact a trade can have on price movement. In this article, we take an investigative look at what crypto market depth means, how it is measured, and why it matters in shaping the future of trading.

Market Depth Explained

At its core, market depth refers to the market’s ability to absorb large buy or sell orders without causing significant price fluctuations. A market with deep liquidity can handle high trading volumes with minimal slippage, while a shallow market sees prices swing wildly even with small orders.

Order Books: The Foundation of Depth

The order book is the engine behind crypto market depth. It records active buy (bid) and sell (ask) orders across different price levels. A deep order book has thick layers of orders on both sides, signaling healthy liquidity. Conversely, a thin order book with sparse orders reflects fragility.

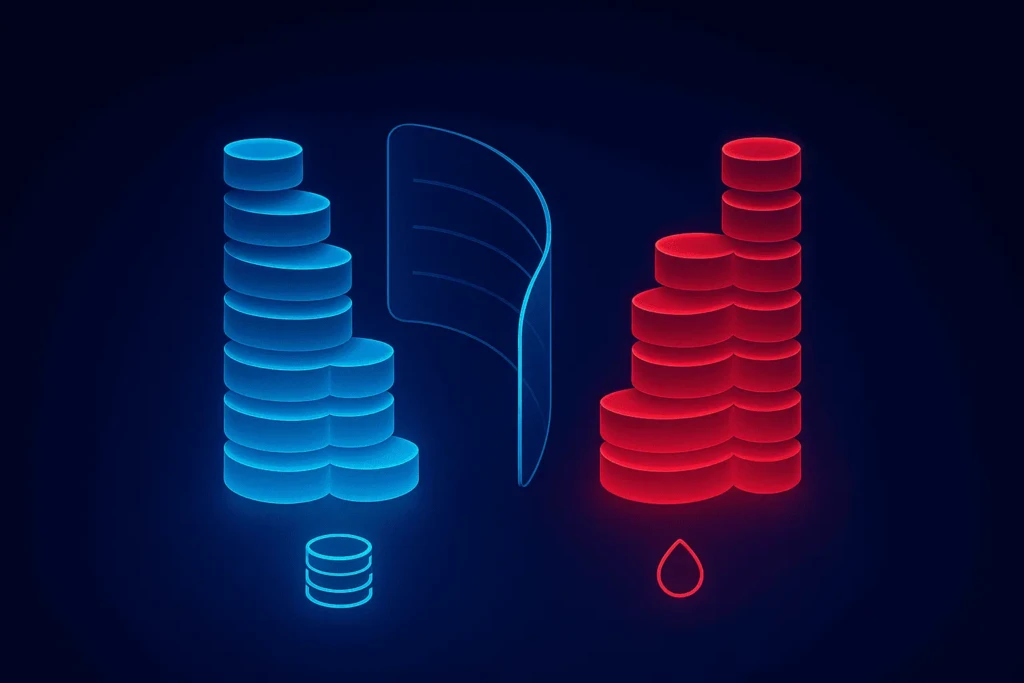

Depth Charts: Visualizing Liquidity

A depth chart visually represents the order book, showing cumulative buy and sell orders. The x-axis reflects price levels, while the y-axis measures volume. Traders use these charts to gauge supply-demand pressure points, potential resistance levels, and liquidity gaps.

Why Market Depth Matters in Crypto

1. Price Stability and Volatility

Cryptocurrencies are often criticized for their volatility. However, deep market depth mitigates wild swings by ensuring that large trades are absorbed smoothly. Shallow depth amplifies volatility, leading to sudden price spikes or crashes.

2. Impact on Trading Strategies

For day traders and institutional investors, understanding market depth is critical. Large players, known as whales, often exploit shallow markets to move prices, while retail traders may face unexpected slippage.

3. Exchange Comparisons

Not all crypto exchanges have the same market depth. Platforms like Binance and Coinbase Pro typically offer deeper liquidity compared to smaller exchanges. This difference directly impacts execution efficiency and trading costs (Coinbase, Binance).

Measuring Crypto Market Depth

Crypto market depth is commonly measured by analyzing the order book liquidity within a given percentage of the mid-market price. For example, one might assess how much volume exists within ±2% of Bitcoin’s current price.

- High Depth: Large volume within a narrow range, showing strong liquidity.

- Low Depth: Small volume within the same range, showing weak liquidity.

Exchanges and analytics providers like CoinGecko often publish liquidity and depth metrics that traders can monitor in real time.

Case Studies: Depth in Action

Bitcoin (BTC) – A Deep Market Example

As the most traded cryptocurrency, Bitcoin enjoys significant depth on major exchanges. Institutional investors can place multi-million-dollar orders with relatively little slippage on platforms like Binance.

Altcoins – Shallow Depth Risks

Many altcoins suffer from shallow depth. A single large order can swing the price by double digits. This creates opportunities for speculative gains but also exposes traders to manipulation risks.

Market Depth vs. Liquidity

While often used interchangeably, market depth and liquidity are not identical.

- Liquidity measures how easily an asset can be bought or sold without affecting price.

- Market depth specifically reflects the distribution of liquidity across price levels in the order book.

In practice, a coin may have high liquidity but poor depth if most orders cluster around specific price levels.

The Role of Market Makers

Market makers—entities that continuously place buy and sell orders—play a vital role in ensuring market depth. By narrowing bid-ask spreads and providing consistent liquidity, they reduce volatility and stabilize markets. Without active market makers, even large-cap cryptocurrencies risk shallow trading environments.

The Dark Side: Market Depth Manipulation

Crypto market depth is not always as transparent as it seems. Traders must be aware of practices like:

- Spoofing: Fake buy/sell orders placed to manipulate perceived depth.

- Wash Trading: Artificial trades designed to exaggerate liquidity.

- Whale Games: Large traders strategically placing and canceling orders to control market psychology.

Regulators worldwide are increasingly scrutinizing exchanges for such practices, but enforcement remains inconsistent.

How Traders Use Market Depth

For Short-Term Trading

Scalpers and day traders monitor depth charts to detect supply-demand imbalances, front-run orders, or spot whale activity.

For Long-Term Investors

Institutional buyers use market depth to plan large accumulations without disrupting prices. For instance, purchasing $10 million worth of Bitcoin is very different on Coinbase versus a small decentralized exchange.

Future Outlook for Crypto Market Depth

As crypto matures, market depth is expected to improve. Factors driving this include:

- Institutional adoption and greater capital inflows.

- Regulatory frameworks encouraging transparent order books.

- Advances in decentralized exchanges (DEXs) with automated liquidity mechanisms.

However, risks remain. Fragmented liquidity across thousands of tokens, shallow altcoin markets, and manipulation tactics will continue to challenge traders.

FAQ: What is Crypto Market Depth?

1. What is crypto market depth in simple terms?

Crypto market depth refers to how much buy and sell order volume exists at different price levels in the order book, indicating the market’s liquidity strength.

2. How does crypto market depth affect traders?

It influences price stability, slippage, and the ease of executing large orders without disrupting the market.

3. Is crypto market depth the same as liquidity?

Not exactly. Liquidity refers to trade ease, while market depth shows how liquidity is distributed across price levels.

4. Why do some altcoins have poor market depth?

Altcoins often lack trading volume and institutional interest, making their order books thin and prone to volatility.

5. Can market depth charts be manipulated?

Yes. Spoofing and wash trading can artificially inflate depth, making careful analysis crucial for traders.

Conclusion: The Strategic Importance of Market Depth

So, what is crypto market depth? It’s not just a technical concept—it’s a lens into market health, trader behavior, and the balance between risk and opportunity. A deep market provides stability, transparency, and fairness, while shallow markets amplify volatility and manipulation risks.

As cryptocurrencies move into mainstream finance, the evolution of market depth will determine how resilient and trustworthy trading becomes. For traders, understanding this metric is no longer optional—it’s essential for navigating the crypto ecosystem intelligently.