Economic Forecast for Bitcoin: A Pivotal December

The economic forecast for Bitcoin took a dramatic turn in December 2024, when the cryptocurrency crossed the long-anticipated $100,000 mark. This watershed moment was not an isolated spike but the culmination of institutional adoption, regulatory shifts, and global macroeconomic pressures converging at once. For investors and policymakers alike, December’s developments offered a preview of how Bitcoin could reshape financial markets in 2025.

Bitcoin Surges Past $100K: A Defining Milestone

The headline-grabbing event of December was Bitcoin’s surge beyond $100,000. Analysts widely credit this rally to the launch of U.S.-approved Bitcoin spot ETFs, which provided a regulated entry point for institutional capital. According to Bloomberg, these ETFs removed barriers that had long kept mainstream investors sidelined.

This milestone marked Bitcoin’s transition from a speculative asset to a recognized part of global financial portfolios. It also sparked renewed debates on whether Bitcoin should be classified as “digital gold” or as an emerging alternative to sovereign currencies.

The Impact of Spot ETFs on Bitcoin’s Economic Outlook

The economic forecast for Bitcoin is inseparable from the role of spot ETFs. Their approval in December represented a turning point for Wall Street’s relationship with digital assets. Unlike futures-based products, spot ETFs directly track Bitcoin’s price, increasing liquidity and potentially reducing volatility over time.

For traditional asset managers, ETFs provided a compliance-friendly gateway into Bitcoin exposure, accelerating capital inflows. If adoption trends continue, ETFs could serve as the foundation for broader Bitcoin integration into pension funds, endowments, and sovereign wealth funds.

Regulatory Shifts Under the Trump Administration

December also brought clarity on the regulatory front. The incoming Trump administration signaled intentions to streamline crypto regulations, marking a stark departure from prior ambiguity. While the details remain to be seen, early policy statements suggested a more pro-growth approach to digital assets.

Regulatory stability is a key driver in the economic forecast for Bitcoin, as it reduces perceived risks for institutions wary of sudden policy reversals. A favorable regulatory stance could accelerate Bitcoin’s acceptance as a legitimate reserve asset in corporate and government balance sheets.

MicroStrategy and the Institutional Bitcoin Playbook

No December review would be complete without mentioning MicroStrategy. Under CEO Michael Saylor, the company expanded its Bitcoin treasury, reinforcing a narrative that Bitcoin is a reliable hedge against fiat currency devaluation.

Other institutions followed suit, with hedge funds and asset managers increasing their exposure. The message was clear: Bitcoin has graduated from fringe speculation to a credible institutional allocation. As CoinDesk noted, Bitcoin’s rising role in diversified portfolios could alter how investors approach both risk management and growth strategies.

Anticipation of the 2025 Halving

Another factor shaping the economic forecast for Bitcoin is the halving event scheduled for April 2025. Historically, halvings have been bullish catalysts, as they cut the rate of new Bitcoin issuance in half. December saw investors positioning early, driving speculative flows and reinforcing the belief that scarcity dynamics will continue to support long-term appreciation.

Global Macroeconomic Forces: Inflation and Rates

Bitcoin’s December rally did not occur in a vacuum. A modest decline in U.S. inflation and a pause in interest rate hikes improved investor sentiment, pushing capital back toward risk assets. For many, Bitcoin served as both an inflation hedge and a speculative play on monetary easing.

These macro conditions remain central to the economic forecast for Bitcoin, as BTC often thrives when fiat currencies face inflationary pressures or when central banks adopt accommodative policies.

Technology, Culture, and Market Volatility

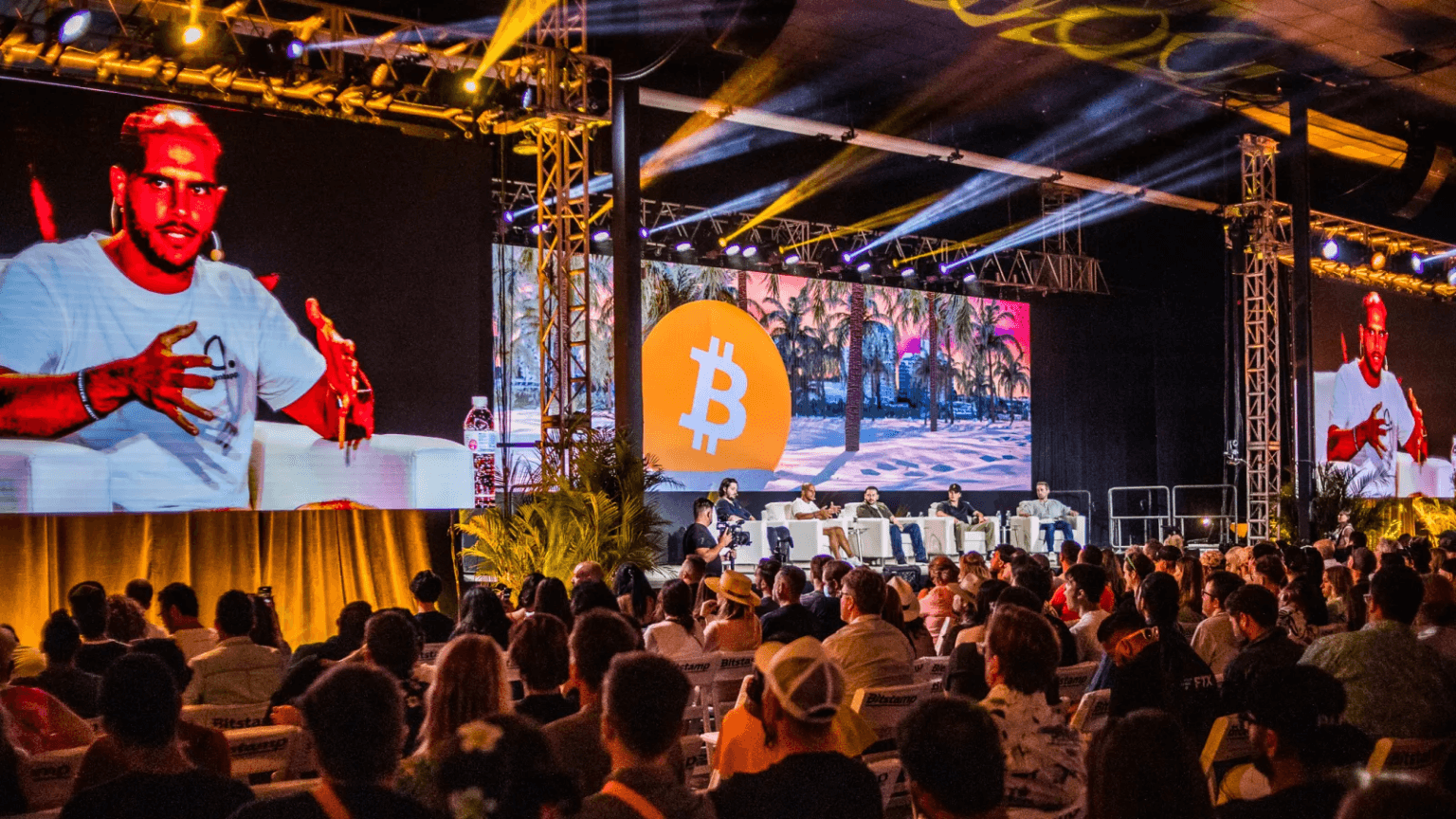

Beyond economics, Bitcoin’s technical progress also made headlines. Upgrades aimed at improving scalability and security gained momentum in December, strengthening Bitcoin’s long-term utility. Simultaneously, documentaries and media coverage on Satoshi Nakamoto reignited public interest, boosting adoption.

Yet volatility remained high. Traders reacted to every regulatory update and ETF announcement, driving price swings that highlighted Bitcoin’s speculative side. For seasoned investors, these dynamics underscored both opportunity and risk in navigating the Bitcoin market.

FAQs: Economic Forecast for Bitcoin

Q1: What is the current economic forecast for Bitcoin after December 2024?

The forecast points to continued institutional adoption, favorable regulatory signals, and bullish sentiment ahead of the 2025 halving, with Bitcoin positioned as both a hedge and growth asset.

Q2: How do Bitcoin spot ETFs influence the economic forecast for Bitcoin?

Spot ETFs make Bitcoin more accessible to traditional investors, boosting liquidity and legitimacy, which in turn supports long-term market stability and growth potential.

Q3: Will the 2025 halving affect the economic forecast for Bitcoin?

Yes. Historically, halvings reduce supply issuance and have driven price increases, making the upcoming event a key factor in shaping Bitcoin’s 2025 outlook.

Q4: What global factors impact the economic forecast for Bitcoin?

Inflation rates, central bank policy, and macroeconomic stability strongly influence Bitcoin demand, often determining whether it acts as a hedge or a speculative asset.

Conclusion: Bitcoin’s Path into 2025

The economic forecast for Bitcoin suggests that December 2024 was more than just a milestone month—it was a preview of structural shifts underway. With spot ETFs opening institutional floodgates, favorable regulatory winds blowing, and the halving event looming, Bitcoin appears poised for further mainstream integration.

Still, volatility and geopolitical uncertainties remain. For investors, the challenge lies not in asking whether Bitcoin has a future, but in anticipating how quickly it will become a cornerstone of the global financial system.