How Does an Iceberg Order Work?

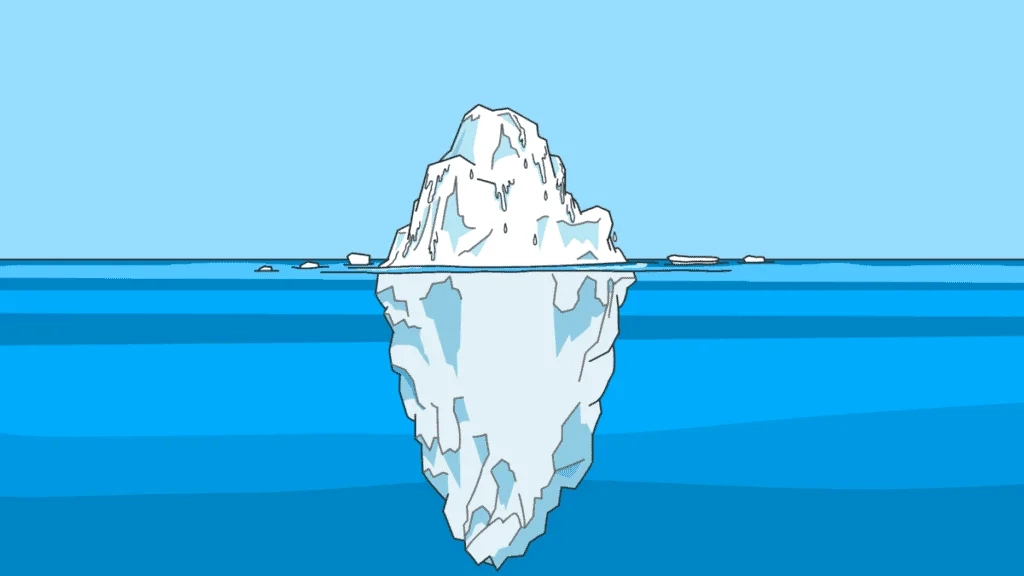

How does an iceberg order work in today’s fast-moving financial markets? At its core, an iceberg order is a sophisticated trading technique designed to conceal the full size of a large buy or sell position. Like the portion of an iceberg hidden beneath the waterline, only a small part of the order is visible to the public order book, while the bulk remains hidden.

This strategy allows institutional traders, hedge funds, and even high-net-worth individuals to execute significant trades without causing dramatic price swings or alerting competitors. But how exactly does it function, and why is it so pivotal in both traditional markets and cryptocurrency exchanges?

The Mechanics Behind Iceberg Orders

Visible vs. Hidden Quantities

An iceberg order splits a large trade into two main parts: the display quantity (the visible tip) and the reserve quantity (the hidden bulk). Only the display quantity is posted to the public order book.

For example, a fund manager who wants to buy 1 million shares of a stock might set the visible portion to 20,000 shares. As those 20,000 shares get filled, another 20,000 from the hidden reserve automatically appears. This process repeats until the entire order is complete.

Automated Execution

Most electronic trading platforms and crypto exchanges support iceberg orders through advanced algorithms. Traders can set parameters such as:

- Peak size (the visible amount)

- Refresh quantity (how much is revealed after each fill)

- Price limits (maximum buy or minimum sell price)

This automation ensures that the market impact is minimized and the order remains discreet.

Why Traders Use Iceberg Orders

Reducing Market Impact

Revealing a million-share purchase at once could push prices higher before the trader acquires the stock. By masking the true size, the trader can secure a better average price.

Maintaining Anonymity

Large institutional investors often prefer not to tip off rivals or algorithmic traders. Iceberg orders make it harder for others to track their intentions.

Enhancing Liquidity Management

Iceberg orders allow traders to participate in the market steadily without absorbing or draining liquidity all at once.

Iceberg Orders in Cryptocurrency Trading

The cryptocurrency market, known for volatility and thin liquidity on certain tokens, has embraced iceberg orders. Major exchanges like Binance and Coinbase Pro offer this feature to professional traders.

- Crypto Example: A whale might wish to sell 500 BTC without triggering a price drop. By revealing only 5 BTC at a time, the market perceives normal trading activity rather than a large sell-off.

Risks and Criticisms

While iceberg orders provide strategic advantages, they are not without controversy:

- Transparency Concerns: Critics argue that hiding large orders reduces market transparency.

- Detection Algorithms: Sophisticated market participants use tools to identify iceberg patterns, potentially undermining the strategy.

- Execution Risk: If the market moves quickly, the hidden portion may remain unfilled, leaving traders with partial positions.

For an academic perspective, the U.S. Securities and Exchange Commission’s guidance on hidden orders outlines regulatory considerations.

Identifying Iceberg Orders

Time & Sales Analysis

Traders watch for repeated small fills at the same price level, a sign that a hidden reserve is replenishing the visible amount.

Order Book Clues

If a specific price repeatedly shows the same small order size despite heavy trading, it could be the “tip” of an iceberg.

FAQ: How Does an Iceberg Order Work?

How does an iceberg order work compared to a standard limit order?

A standard limit order reveals the full trade size, while an iceberg order shows only a fraction, keeping the remainder hidden until each portion is filled.

How does an iceberg order work in cryptocurrency markets?

Crypto exchanges automate iceberg orders to help traders buy or sell large token amounts without creating sudden price spikes.

How does an iceberg order work to reduce market impact?

By splitting the order into smaller visible parts, it prevents a sudden surge or drop in prices that would occur if the entire trade were disclosed at once.

How does an iceberg order work when detected by algorithms?

If other traders detect the pattern, they might adjust their strategies, potentially causing the price to move against the iceberg trader.

Looking Ahead: The Future of Iceberg Orders

The financial landscape is evolving with faster algorithms, decentralized exchanges, and AI-driven trading. While iceberg orders remain a vital tool, the increasing sophistication of detection methods may challenge their effectiveness.

Regulators may also scrutinize hidden liquidity practices more closely as market fairness becomes a priority. In crypto markets, where transparency is valued but large trades are common, the strategy’s role will likely grow—yet so will efforts to expose it.

Analytical Conclusion

How does an iceberg order work in shaping market dynamics? It remains a powerful tactic for executing large trades discreetly, balancing the need for privacy with the demands of an open market. As technology advances and market participants become more adept at spotting these hidden moves, the strategy will continue to evolve, reflecting the ongoing tension between transparency and competitive advantage.