The president-elect ran on a crypto-friendly agenda and is touting a cryptocurrency venture himself.

Over the course of the weekend, the project’s value significantly increased as Trump and his advisors made preparations to return to the White House. By Monday, Trump is anticipated to announce new policy directives that may relax cryptocurrency regulations, potentially causing a surge in the prices of bitcoin and other digital assets.

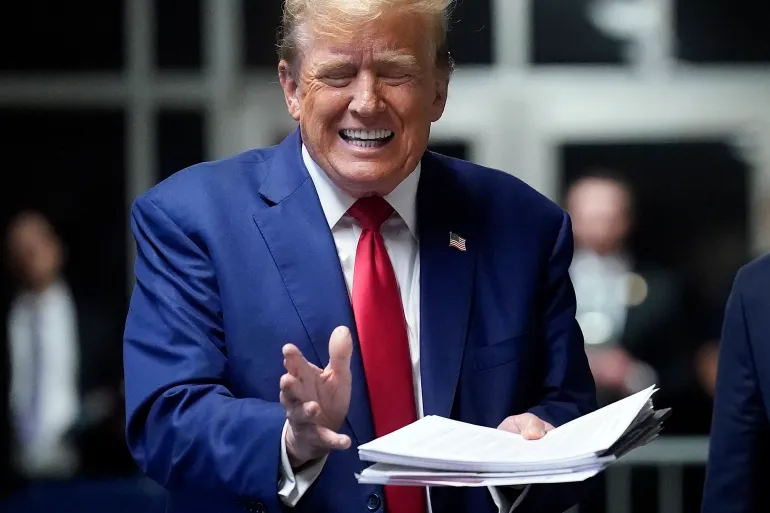

Trump’s latest initiative is referred to as a meme coin, a type of token characterized by significant volatility, which cryptocurrency enthusiasts can trade in relation to a current online trend or figure. Specifically, this token features an image of Trump raising his fist, inspired by the assassination attempt that occurred in July. Named $TRUMP, the prospective president has positioned this new venture as a means for his supporters to “celebrate everything we represent.”

It may have created the potential for billions of dollars in wealth for the Trump business, just hours before he is scheduled to commence a term in which he has pledged to transform the United States into the “crypto capital of the planet,” as he expressed to industry supporters at a significant conference last year.

Purchasers are acquiring what can be characterized as a digital playing card, intended to represent a gesture of support rather than an investment opportunity or a political contribution, as detailed in extensive disclosures available online.

A digital company associated with the Trump organization holds an 80 percent stake in the supply, as revealed by the project, and seems to earn a commission on sales. Additionally, Trump has endorsed the project to his approximately 97 million followers on the social media platform X, and on Sunday, he directed his followers towards a comparable meme coin linked to future first lady Melania Trump.

By Sunday evening, the overall valuation of the $TRUMP project surpassed $67 billion, as reported by CoinMarketCap, which monitors cryptocurrency prices and derived this figure by calculating the total market capitalization assuming all coins were in circulation.

The president-elect’s sons, Eric and Donald Jr., referred to the initiative this weekend as the “most popular digital meme globally,” asserting that the Trump family’s distinct cryptocurrency venture—entitled World Liberty Financial, which includes a new token and platform—would represent the “future of finance.”

Jordan Libowitz, a senior vice president at Citizens for Responsibility and Ethics in Washington, who specializes in cryptocurrency analysis, stated that the coin exemplifies how Trump could exploit “every governmental resource available to him for personal financial gain.”

Norman Eisen, who served as an ethics adviser in the White House during the Obama administration, stated that among the various conflicts faced by Trump as a businessman who became president, this particular situation could be considered the most significant.

Eisen stated, “He is initiating a significant new multibillion-dollar enterprise within the rapidly expanding cryptocurrency sector, where he faces a substantial conflict of interest between his personal ambitions and his responsibilities to oversee that industry—an industry that now encompasses his own activities. This situation could be regarded as the most egregious conflict of interest in the contemporary history of the presidency.”

Eisen further observed that foreign governments might invest in the meme coin, which could increase its value and enhance Trump’s wealth, potentially contravening the foreign emoluments clause of the Constitution.

Eisen cautioned that while cryptocurrency has the potential to flourish, it must also be subject to suitable regulations. In the absence of such oversight, it may be exploited as a means for money laundering, tax evasion, and financing terrorism.

A representative for the Trump transition was not available to provide a comment at this time. Similarly, a representative from the Trump Organization also did not respond promptly.

The initiative highlighted Trump’s significant shift from being a critic of cryptocurrency to becoming an advocate, as he seeks to attract the substantial political contributions from the industry and maintain its support as he embarks on his second term in the White House.

Years after denouncing cryptocurrency as a “scam,” Trump has sought to position himself as the inaugural crypto president, enlisting the support of advisors with significant connections to the notoriously unstable sector.

The advisory team comprises individuals such as David Sacks, a venture capitalist from Silicon Valley who is expected to assist Trump in formulating cryptocurrency policy within the White House, and Paul Atkins, a former consultant for cryptocurrency firms, whom the president has put forward as a candidate to head the Securities and Exchange Commission, a significant regulatory authority in finance. Additionally, several of Trump’s advisers during the transition period have strong connections to Marc Andreessen and his venture capital firm, which holds substantial investments in the cryptocurrency sector.

Andreessen and several prominent figures in the cryptocurrency sector, such as Tyler and Cameron Winklevoss, the creators of the trading platform Gemini, made substantial donations to Trump and related organizations throughout the 2024 campaign. Their contributions were aimed at countering the prolonged criticism they faced during the administration of outgoing President Joe Biden.

The results of their efforts may become evident shortly after Trump assumes office. He is anticipated to establish a new council, which will include some cryptocurrency executives, to provide guidance to his administration, as indicated by two individuals familiar with the situation who requested anonymity to discuss his intentions.

Trump has also considered the implementation of executive orders aimed at simplifying federal cryptocurrency regulation. This could involve directing agencies to examine and eliminate legal obstacles facing the industry or providing clarity on the specific oversight responsibilities of two federal financial regulators, namely the SEC and the Commodity Futures Trading Commission, according to sources. Additionally, the president’s team has engaged in discussions with legislators and experts regarding his contentious proposal to establish a federal reserve of bitcoin, as previously reported by The Washington Post.

Trump and his family have associated their names and provided support to World Liberty Financial, a company focused on crypto lending; however, they do not seem to hold any official positions within the organization.

The projects have brought to light recurring concerns regarding Trump’s blending of governmental responsibilities with business interests, as well as the potential motivations of political figures who may attempt to gain favor by investing in his expanding real estate and technology ventures. The significance of these issues became evident shortly after the election, when Chinese cryptocurrency entrepreneur Justin Sun acquired $30 million in tokens from World Liberty Financial. It is noteworthy that Sun is currently under investigation by the SEC.

The president-elect has additionally marketed non-fungible tokens (NFTs) that showcase simplistic images of himself engaging in golf, portraying an astronaut, or being encircled by gold bars.