Solana’s price has experienced a resurgence, rising for five consecutive days and achieving its highest level since December 6.

Solana reached a peak of $245 on Saturday, marking a 42% increase from its lowest value this month, which elevates its market capitalization to $117 billion. This achievement positions it as the fifth-largest cryptocurrency, following Bitcoin, Ethereum, Ripple, and Tether.

Several key factors have contributed to the recent surge in SOL’s value, and it is anticipated that this upward trend will persist.

1-Solana’s ecosystem growth

Solana has experienced significant growth due to the continuous expansion of its ecosystem. The market capitalization of its meme coins has surged, reaching over $22 billion. The official Trump (TRUMP) coin, introduced by President-elect Donald Trump on January 17, boasts a valuation of $4.4 billion.

Several other well-known meme coins within the ecosystem include Bonk (BONK), Dogwifhat (WIF), and Pudgy Penguins (PENGU).

Solana has established itself as a significant contender in the non-fungible token market. As reported by CryptoSlam, the sales of Solana’s NFTs exceeded $81 million in the past 30 days, positioning it as the third-largest player in the industry, following Ethereum and Bitcoin.

Solana’s ecosystem is likely to experience further expansion due to its rapid transaction speeds, reduced costs, and the increasing popularity of its Decentralized Exchange networks. Recent data indicates that Solana’s DEX networks processed $32.2 billion over the past week, significantly surpassing Ethereum’s $9.2 billion.

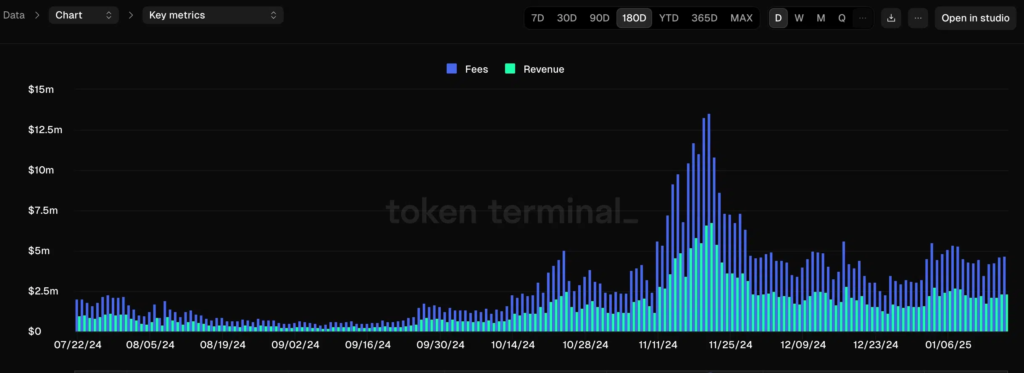

The increase in activity has resulted in elevated network fees, amounting to $820 million over the past year and $77 million in the current year. A portion of these funds is distributed to Solana stakers, who are benefiting from a yield of 7%.

2-SOL ETF hopes are steady

The price of Solana has experienced an increase as investors speculate on the likelihood of an exchange-traded fund (ETF) approval by the Securities and Exchange Commission. A recent poll conducted by Polymarket indicates a 77% probability of this approval, suggesting that the agency, led by Paul Atkins, may be more receptive to granting such approvals.

A Solana ETF is expected to significantly increase demand for the cryptocurrency among institutional investors. This demand could be further amplified if the regulatory agency permits staking of these tokens. In a recent report, JPMorgan projected that a Solana ETF could draw in between $3 billion and $6 billion within its inaugural year.

3-Solana price technicals are supportive

The daily chart indicates that the SOL token experienced a rebound following the establishment of a double-bottom pattern at $175.42. It has subsequently surpassed the neckline of the pattern, which is positioned at $222.95, marking its highest swing recorded on January 6.

Solana, established in 2020 by engineer Anatoly Yakovenko, continues to trade above the ascending trendline that links the lowest points since January 23 of the previous year. It has consistently stayed above the 50-day moving average, and the Relative Strength Index has shown an upward trend.

Consequently, it is anticipated that the price of Solana will persist in its upward trajectory, a trend that will be validated should the token surpass the significant resistance level of $264.15, which represents its peak for the year 2024.

Solana up until now

Yakovenko conceptualized a blockchain that could accommodate millions of transactions per second, addressing the concerns raised by critics regarding Ethereum’s sluggish transaction speeds and elevated fees. This network is intended to facilitate decentralized applications (dApps) and cryptocurrency transactions.

Solana claims to offer quicker transaction processing and superior throughput compared to numerous competitors in the market.

Following its mainnet launch in 2020, Solana rapidly captured interest due to its high transaction speed and minimal costs, drawing in both developers and investors. In 2021, the network experienced significant expansion, hosting a variety of decentralized finance (DeFi) initiatives and non-fungible tokens on its platform.

Solana, which is presently supported by prominent venture capital firms such as Andreessen Horowitz, is experiencing swift advancement through effective blockchain solutions within the expanding cryptocurrency sector.